What became very clear in this crisis is that companies that were prepared for new marketing techniques, specifically within the ecommerce channel, and those able to adapt to the new buzz word, “digital transformation” (defined as companies making their relevant offers and services that are consistent with a focus on customer experience and with ecommerce being the main element in keeping the business thriving), have learned making this previous investment into e-commerce kept businesses alive. Some of course are thriving and wondering when or if it is all going to end.

I said when this all started that my personal belief is that ecommerce will remain the center of the retail experience going forward. This pandemic was the catalyst that took it from greater than $546.6B just in the first three quarters up 32.6% YOY annual sales, still rising in the range of 25-30%, as Bricks and Mortar fall by approximately 15%. This is according to the stats from digitalcommerce360.

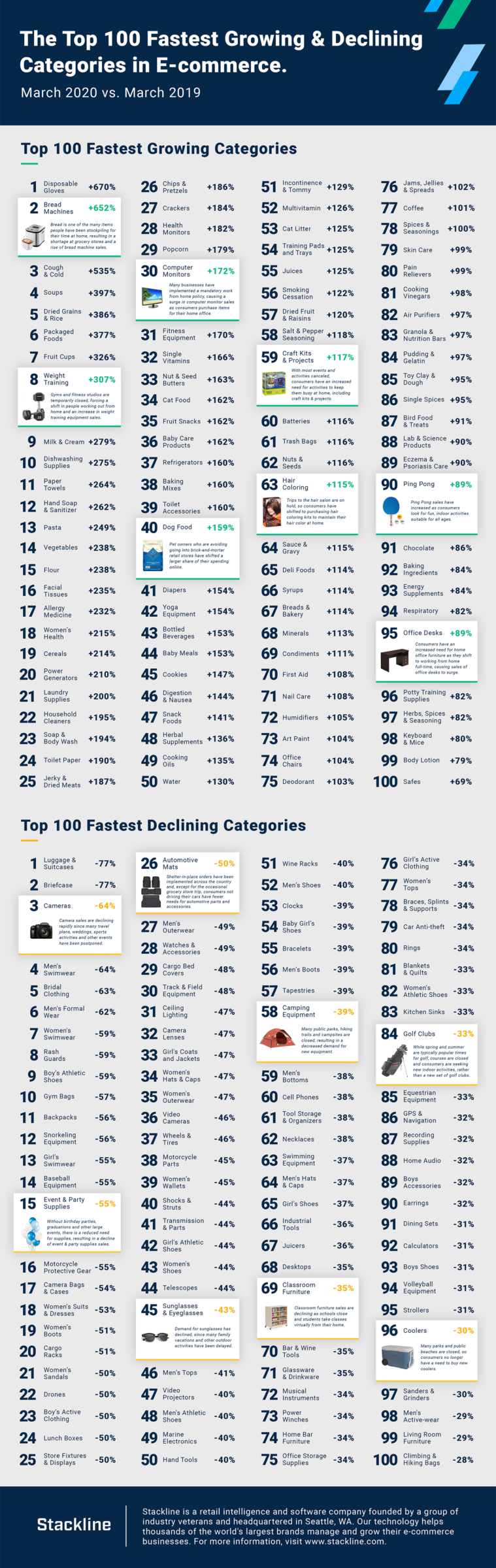

Looking into some additional research from companies such as Stackline.com, we find the top 100 retailers gaining steam and those declining. The initial big ones that surfaced first are home fitness and training equipment, while many outdoor sports categories such as baseball & softball and track & field are in decline. Since many companies implemented the work-from-home policy, demand for computer peripherals office supplies and equipment skyrocketed. As most travel had been either halted or curtailed the luggage, briefcase, and camera categories suffered. Additionally, many spring break vacations were canceled, triggering a decline across sandal and swimwear categories. Stackline.com also pointed out that the formal apparel categories, “including Bridal and Men’s Suits are in decline as many couples are forced to cancel or delay their weddings.”

The main point here is that consumer spending has shifted to meeting needs of families spending more time at home. However, this encourages the eCom marketplace not only for the young, but for the over 50 and Baby Boomers, who in the past were more reluctant to buy online. They are now one of the fastest growing categories of e-commerce shoppers. They are buying just about everything they need, including groceries. Most love this new-found convenience and realize it’s not as difficult as they thought to navigate, and of course the safety factor of staying away from other shoppers is a big motivator.

This huge surge has caused the backbone of ecommerce to have to make rapid changes and adjustments to keep up. Our small package carriers, Such as DHL eCom, UPS, FDX and USPS are now in a place where increased home deliveries are taxing their infrastructures. Along with this, the fulfillment centers that pick pack and ship are having to expand into larger spaces to support the influx of retailer’s inventories. As order volumes continue to burst 3X above the norm, much more automation to keep up is a necessity. The carriers are doing all they can to keep up by implementing new sortation facilities, and increasing delivery networks and equipment. The industry is aware that this is not a temporary burst. In a short time they will answer the call by implementing high capacity innovations and operational enhancements, with a much more robust infrastructure to support the expanding retail shopping norm.

AMS is one of those industry innovators taking steps to support this amazing growth, ready and poised to support your eCommerce fulfillment requirements. Equipped with bi-coastal locations totaling over 1M square feet across eight facilities, AMS has shipped to 194 of the world’s countries and every continent except Antarctica.

Let us know how we can help improve your supply chain.

JB/ Freight Freak

___________________

About the Freight Freak:

John Bevacqua is the VP of Logistics at AMS Fulfillment. His area of excellence is in creating distribution and fulfillment operations that function as a capable interface between suppliers, retailers, and wholesale distributors. His experience includes developing and leading FedEx/ Kinko’s Distribution Services into the FedEx post acquisition, USA Wireless Technologies, and a top Logistics Management company. He has also worked with third party fulfillment companies, preparing him for his current position with AMS Fulfillment.